BE Bot 69B

Start your digital transformation with BE Bot 69B, automate the process of tracking your suppliers and business partners in real time within the 69-B blacklist of the SAT with a bot to download and cross-check periodic information.

When the tax authority detects that a taxpayer has been issuing receipts without having the resources and infrastructure to support its operation, the non-existence of the operations covered by such receipts will be presumed, which will cause the taxpayer to be classified as one of the following figures :

Company that Bills Simulated Operations (EFOS)

-

Three to six years in prison.

-

Nullifying the certificates issued

Company that Deducts Simulated Operations (EDOS)

- Three months to six years in prison.

- Penalty from 55% to 75% of the transaction value

SAT 69-B blacklist status

Alleged

Newly published taxpayer, is pending to present evidence to be distorted.

Distorted

Taxpayer who provided sufficient evidence to prove the existence of the operations.

Definitive

Taxpayer who provided insufficient evidence or, where appropriate, omitted them, confirming the non-existence of the operations.

Favorable judgment

Taxpayer who presented a means of defense against the presumption of non-existent operations.

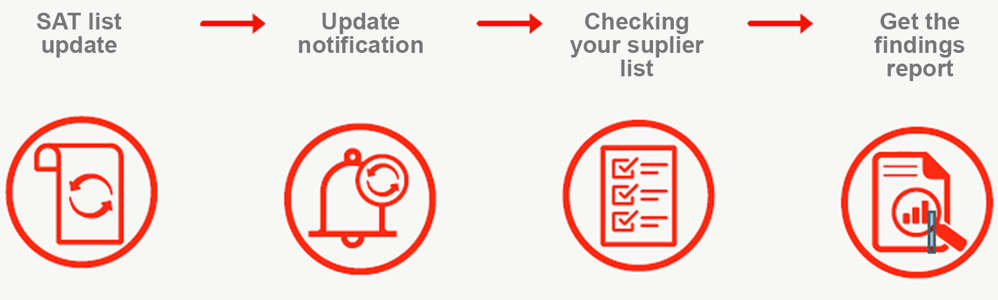

How does it works?

Brochure

Download our brochure and learn how BE Bot 69B, our bot will help you monitor your suppliers and business partners automatically